- Four suspects linked to the KUSCCO fraud scandal will remain in custody until February 18, 2025, when their bail terms will be determined.

- Former KUSCCO MD George Ototo has been summoned for plea-taking on the same day.

- A PwC forensic audit uncovered Ksh.13.3 billion in losses, Ksh.3.7 billion in bad loans, and Ksh.2.7 billion in irregular commissions.

- The DCI and EACC have been called upon to prosecute those involved, while the Assets Recovery Agency seeks to reclaim stolen funds.

- Authorities are pursuing other officials suspected of involvement in the scandal.

KUSCCO Fraud Suspects Remain in Custody as Investigations Deepen

Four senior officials of the Kenya Union of Savings and Credit Co-operatives (KUSCCO) will remain in custody until February 18, 2025, as the court deliberates on their bail terms.

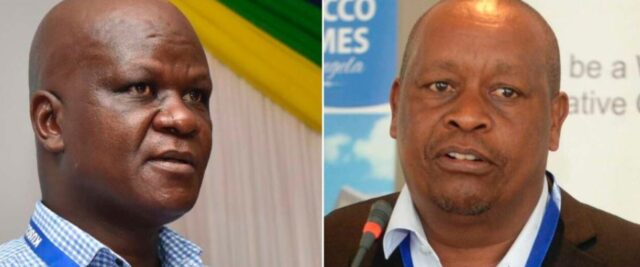

The accused—George Magutu Mwangi, Mercy Muthoni Njeru, George Ochola Owino, and Jackline Pauline Atieno Omolo—were arraigned at the Milimani Law Courts, facing charges of conspiracy to defraud, theft by directors, and falsifying documents.

Former KUSCCO MD Summoned

Former KUSCCO Managing Director George Otieno Ototo has also been summoned to appear in court for plea-taking on the same day.

According to the Directorate of Criminal Investigations (DCI), Ototo is implicated in the scandal and is expected to answer charges.

PwC Audit Exposes Massive Financial Mismanagement

A forensic audit by PricewaterhouseCoopers (PwC) uncovered staggering financial irregularities at KUSCCO, including:

- Ksh.3.7 billion in non-performing loans.

- Ksh.797.9 million in overstated profits over six years.

- Ksh.2.7 billion in irregular commission payments.

The DCI and Ethics and Anti-Corruption Commission (EACC) have been tasked with further investigations, while the Assets Recovery Agency seeks to recover lost funds.

A Deep-Rooted Web of Corruption

The audit revealed widespread corruption within KUSCCO, including:

- Fabrication of financial records to cover losses.

- Bribery and unexplained bank withdrawals.

- Massive executive theft and money laundering.

- Conflict of interest in awarding contracts to firms owned by senior managers.

As a result, KUSCCO is now insolvent by Ksh.12.5 billion, putting Ksh.24.8 billion from 247 Saccos at risk.

Ongoing Investigations

Police are now tracking down other former KUSCCO officials believed to be involved in the fraud. The scandal has raised concerns over governance and financial transparency in Kenya’s cooperative sector.